Making a charitable gift of shares to Kent Community Foundation is a highly tax effective way of supporting local causes close to your heart.

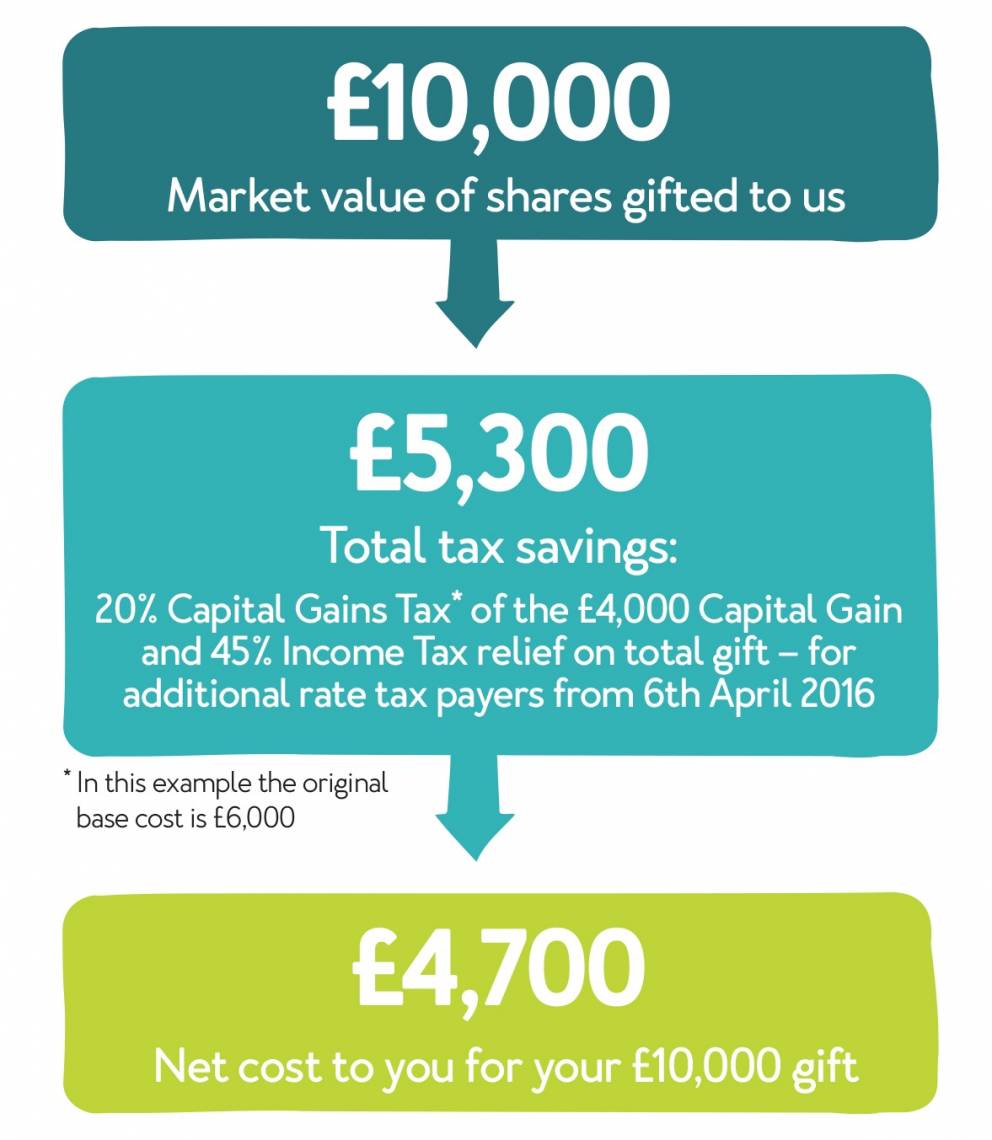

Gifts of shares benefit from tax relief in two ways:

- You can claim Income Tax relief on the value of the shares

- They are exempt from Capital Gains Tax i.e. you will not be taxed on any gain you have made on the value of your shares

You can sell your shares and donate the proceeds to us as a donation. We will request the details of your stockbroker and shares sold for auditing purposes. By donating the proceeds as cash, depending on your circumstances, we may be able to claim gift aid, increasing your donation by 25% and you can also claim higher rate or additional rate tax relief on the gross value of the cash donation, after taking into account the gift aid tax claimed.

If you are interested in donating shares to support your local community, please contact KCF on01303 814 500development@kentcf.org.uk